Press Releases

31-10-2022 14:57

Labour Cost Survey Results 2020

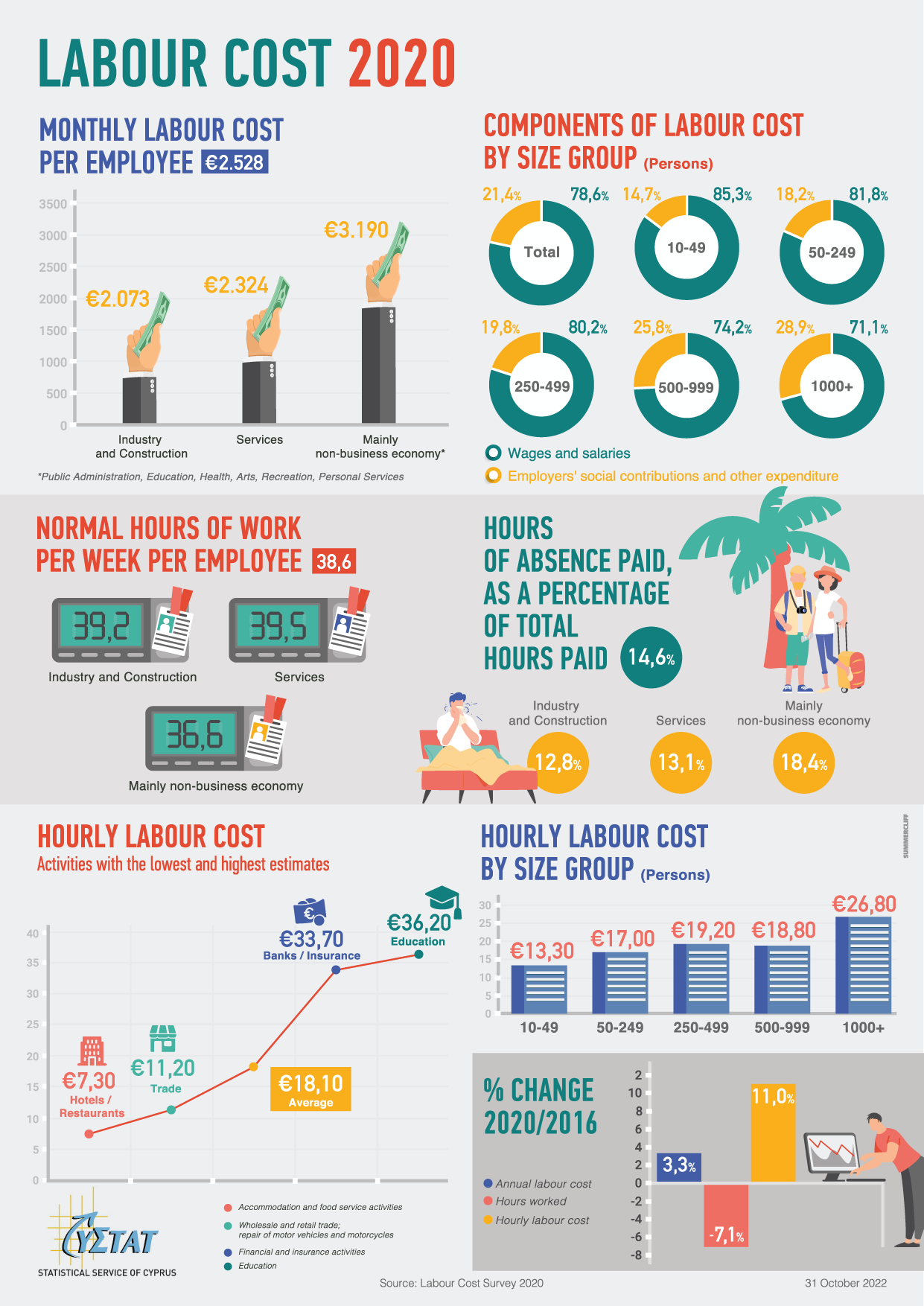

Hourly Labour Cost €18,10

According to the results of the Labour Cost Survey (LCS), with reference year 2020, the hourly cost (labour cost per hour worked) for the whole economy (excluding sections Agriculture, Forestry and Fishing, Activities of Households as Employers and Activities of Extraterritorial Organizations and Bodies) is €18,10.

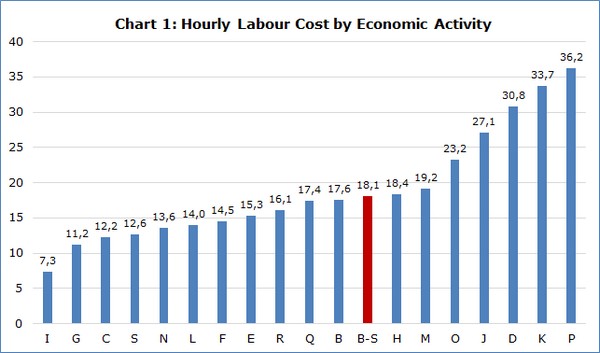

Hourly Labour Cost

The hourly labour cost by economic activity exhibits large deviations. The lowest hourly labour cost is recorded in the sector of Accommodation and Food Service Activities, at €7,30, followed by €11,20 in the sector of the Wholesale and retail trade; Repair of motor vehicles and motorcycles. The highest is recorded in the Education sector with €36,20, followed by the Financial and Insurance Activities sector with €33,70. (Chart 1)

Annual and Monthly Labour Cost

The annual labour cost per employee in full-time units (FTU) without apprentices, in 2020 is €30.335 and the corresponding monthly cost is €2.528. The sector of Accommodation and food service activities has the lowest annual and monthly cost per employee with €11.201 and €933 respectively, while Financial and Insurance Activities sector has the highest among the economic activities with €55.467 and €4.622. (Table)

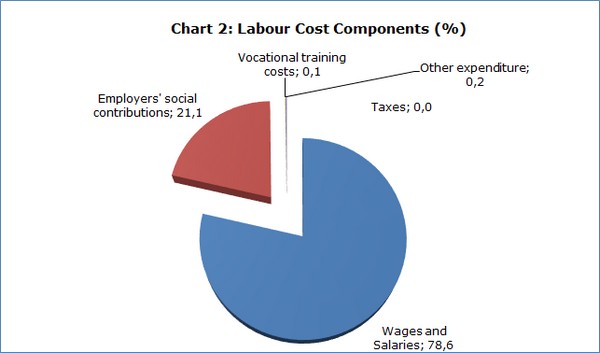

Components of Labour Cost

The total labour cost is composed mainly of Wages and Salaries (78,6%) and Employers’ Social Contributions (21,1%). Vocational Training, Other Expenditures paid by the employer and Taxes paid by the employer, comprise a minor part of the total costs. (Chart 2)

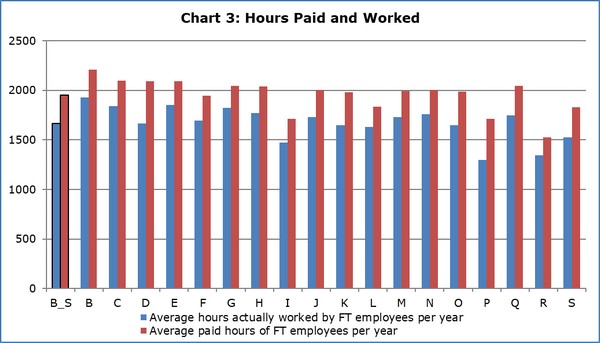

Hours Worked and Hours Paid

The average hours actually worked by full-time employees per year range from 1.296 (Education) to 1.926 (Mining and quarrying). The average paid hours for full-time employees per year range from 1.527 (Arts, entertainment and recreation) to 2.207 (Mining and quarrying). (Chart 3)

|

Table: Annual and monthly cost per employee |

|||

|

Nace |

Economic Activity |

Annual cost per employee in FTU without apprentices |

Monthly cost per employee without apprentices |

|

B-S |

Total - Industry, Construction and Services |

30.335 |

2.528 |

|

B |

Mining and Quarring |

33.886 |

2.824 |

|

C |

Manufacturing |

22.534 |

1.878 |

|

D |

Electricity, Gas, Steam and Air Conditioning Supply |

51.296 |

4.275 |

|

E |

Water Supply; Sewerage, Waste Management and Remediation Activities |

28.404 |

2.367 |

|

F |

Construction |

24.633 |

2.053 |

|

G |

Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles |

20.454 |

1.704 |

|

H |

Transportation and Storage |

32.557 |

2.713 |

|

I |

Accommodation and Food Service Activities |

11.201 |

933 |

|

J |

Information and Communication |

47.061 |

3.922 |

|

K |

Financial and Insurance Activities |

55.467 |

4.622 |

|

L |

Real Estate Activities |

22.906 |

1.909 |

|

M |

Professional, Scientific and Technical Activities |

33.149 |

2.762 |

|

N |

Administrative and Support Service Activities |

23.938 |

1.995 |

|

O |

Public Administration and Defence; Compulsory Social Security |

38.191 |

3.183 |

|

P |

Education |

47.139 |

3.928 |

|

Q |

Human Health and Social Work Activities |

30.427 |

2.536 |

|

R |

Arts, Entertainment and Recreation |

21.656 |

1.805 |

|

S |

Other Service Activities |

19.316 |

1.610 |

METHODOLOGICAL INFORMATION

Survey Identity

The Statistical Service of Cyprus has carried out the Labour Cost Survey with reference year 2020. The Cyprus Statistical Service has carried out the LCS for the sixth time (2020, 2016, 2012, 2008, 2004, 2000), in compliance with the Council Regulation (EC) No 530/1999 concerning structural statistics on earnings and on labour costs and the Commission Regulation 1737/2005 of 21 October 2005 amending Regulation (EC) No 1726/1999 as regards the definition and transmission of information on labour costs. The results provide data on labour cost, hours of work and labour cost per hour, analyzed by economic activity and enterprise size.

Definitions

Labour costs mean the total expenditure borne by employers in order to employ staff. Labour costs include compensation of employees with wages and salaries in cash or in kind and employers’ social contributions, vocational-training costs, other expenditures, taxes relating to employment regarded as labour costs, less any subsidies received.

The results of the survey reflect the special circumstances of the reference year, since the government’s measures to deal with the pandemic affected both labor costs and working hours. Moreover, this situation has led to further difficulty in collecting the data. It is clarified that, as regards the wages and salaries of employees who participated in the Special Schemes of the Ministry of Labour and Social Insurance in the framework of the Employees’ Support Measures to deal with the pandemic, the amount taken into account is the earnings paid by the employer and does not include any amount paid as an allowance by the Ministry of Labour and Social Insurance.

Hourly labour cost is the labour cost per actual hour worked.

Annual cost per employee in FTU without apprentices is the annual labour cost, without the cost of employing apprentices, per employee in full-time units.

Monthly cost per employee without apprentices is the annual cost per employee in FTU without apprentices divided by 12.

Hours actually worked are defined as the sum of all periods spent on direct and ancillary activities to produce goods and services. Hours actually worked include hours worked during normal periods of work, overtime, short breaks and hours spent in training. Hours actually worked exclude hours paid but not worked (holidays, public holidays, paid sickness and maternity leaves) and hours not worked and not paid, for example, during unpaid sickness and maternity leaves.

Hours worked should be “actual hours worked” rather than “contracted hours”. However, these may not always be easy to obtain and it may be necessary to make use of contractual hours instead. This usually occurs for some professional groups – as in the case of teachers who generally work more overtime on an unpaid basis.

Hours paid cover the total number of hours paid by all employees during the year. The total number of hours actually paid is recorded separately for full-time employees, part-time employees and apprentices.

The annual number of paid hours is defined as:

— normal and overtime hours remunerated during the year,

— any hours for which the employee was paid at a reduced rate, even if the difference was made up by payments from social-security funds,

— hours not worked during the reference period but nevertheless paid (e.g. annual holidays, sick leave, public holidays).

Coverage and Collection of Data

Statistical unit

The statistical unit is the enterprise or local unit. The government has a number of local units conducting different economic activities. Data were selected for each local unit separately.

Coverage of employees

All enterprises with 10 or more employees in economic activities NACE Rev. 2 sections B to S were covered. Both private and public sectors were covered.

Economic Activities Coverage

NACE Rev. 2 sections B to S (Industry, construction and services) are covered.

Enterprise Size Coverage

The size of the enterprise, in terms of the number of employees, is classified using the following bands: 10 to 49, 50 to 249, 250 to 499, 500 to 999, 1000 and more employees.

Reference area

Government controlled area of the Republic of Cyprus.

For more information:

CYSTAT Portal, subtheme Labour Cost and Earnings

Publications

CYSTAT-DB (Online Database)

Methodological Information

Infographic

Contact

Phani Lagou: Tel:+35722602115, Email: plagou@cystat.mof.gov.cy

(MV/ECHR)

Relevant Press Releases

19-04-2024 16:42

PIO e-mail Αlerts service is suspended

18-04-2024 14:04

Price Index of Construction Materials: March 2024

17-04-2024 13:26

Harmonised Index of Consumer Prices (HICP): March 2024