Press Releases

02-06-2023 14:29

Quarterly Accounts of General Government: 1st quarter 2023

Surplus €329,1 mn

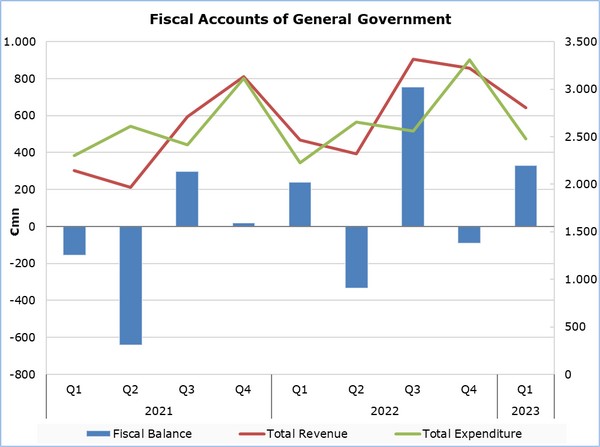

The preliminary General Government fiscal results, which are prepared by the Statistical Service of Cyprus (CYSTAT) indicate a surplus of €329,1 mn for the period of January-March 2023, as compared to a surplus of €239,9 mn that was recorded during the period of January-March 2022.

Revenue

During the period of January-March 2023, total revenue increased by €337,5 mn (+13,7%) and amounted to €2.803,7 mn, compared to €2.466,2 mn in the corresponding period 2022.

In detail, taxes on production and imports increased by €72,5 mn (+8,0%) and amounted to €975,6 mn, compared to €903,1 mn in the first quarter of 2022, of which net VAT revenue increased by €13,2 mn (+2,2%) and amounted to €626,6 mn, compared to €613,4 mn in the corresponding quarter of 2022. Social contributions increased by €111,0 mn (+15,1%) and amounted to €844,2 mn, compared to €733,2 mn in the first quarter of 2022. Revenue from taxes on income and wealth increased by €162,7 mn (+26,7%) and amounted to €772,5 mn, compared to €609,8 mn in the corresponding quarter of 2022. Capital transfers increased by €0,3 mn (+7,3%) and amounted to €4,4 mn, compared to €4,1 mn in the first quarter of 2022. Property income receivable increased by €0,8 mn (+3,6%) and amounted to €23,1 mn, compared to €22,3 mn in the corresponding quarter of 2022.

On the contrary, current transfers decreased by €6,1 mn (-12,8%) to €41,4 mn, from €47,5 mn in the first quarter of 2022. Revenue from the sale of goods and services decreased by €3,7 mn (-2,5%) to €142,5 mn, from €146,2 mn in the corresponding quarter of 2022.

Expenditure

During the period of January-March 2023, total expenditure increased by €248,3 mn (+11,2%) and amounted to €2.474,6 mn, from €2.226,3 mn in the corresponding period of 2022.

Specifically, social transfers increased by €88,6 mn (+9,6%) and amounted to €1.013,9 mn, compared to €925,3 mn in the first quarter of 2022. Compensation of employees (including imputed social contributions and pensions of civil servants) increased by €67,5 mn (+9,4%) and amounted to €787,0 mn, compared to €719,5 mn in the corresponding quarter of 2022. Intermediate consumption increased by €35,2 mn (+16,6%) and amounted to €247,1 mn, compared to €211,9 mn in the first quarter of 2022. Subsidies increased by €0,5 mn (+2,4%) and amounted to €21,2 mn, compared to €20,7 mn in the corresponding quarter of 2022. Other current expenditure increased by €5,3 mn (+3,2%) and amounted to €168,8 mn, compared to €163,5 mn in the first quarter of 2022.

The capital account increased by €59,8 mn (+60,3%) and amounted to €159,0 mn (€132,3 mn capital formation and €26,7 mn capital transfers), compared to €99,2 mn (€74,1 mn capital formation and €25,1 mn capital transfers) in the corresponding quarter of 2022.

On the contrary, property income payable decreased by €8,6 mn (-10,0%) to €77,6 mn, from €86,2 mn in the first quarter of 2022.

|

Table |

||||

|

Macroeconomic Aggregates of General Government |

Euro (million) |

Change |

||

|

Fiscal Results |

Difference |

(%) |

||

|

Q1 2022 |

Q1 2023 |

Q1 2023/22 |

Q1 2023/22 |

|

|

Total Revenue |

2.466,2 |

2.803,7 |

337,5 |

13,7 |

|

Taxes on Production and Imports |

903,1 |

975,6 |

72,5 |

8,0 |

|

of which VAT |

613,4 |

626,6 |

13,2 |

2,2 |

|

Current Taxes on Income and Wealth, etc |

609,8 |

772,5 |

162,7 |

26,7 |

|

Social Contributions |

733,2 |

844,2 |

111,0 |

15,1 |

|

Other Current Resources |

216,0 |

207,0 |

-9,0 |

-4,2 |

|

Property income receivable |

22,3 |

23,1 |

0,8 |

3,6 |

|

Current transfers |

47,5 |

41,4 |

-6,1 |

-12,8 |

|

Sales |

146,2 |

142,5 |

-3,7 |

-2,5 |

|

Capital Transfers Received |

4,1 |

4,4 |

0,3 |

7,3 |

|

Total Expenditure |

2.226,3 |

2.474,6 |

248,3 |

11,2 |

|

Total Current Expenditure |

2.127,1 |

2.315,6 |

188,5 |

8,9 |

|

Intermediate consumption |

211,9 |

247,1 |

35,2 |

16,6 |

|

Compensation of employees |

719,5 |

787,0 |

67,5 |

9,4 |

|

Social transfers |

925,3 |

1.013,9 |

88,6 |

9,6 |

|

Property income payable |

86,2 |

77,6 |

-8,6 |

-10,0 |

|

Subsidies |

20,7 |

21,2 |

0,5 |

2,4 |

|

Other current expenditure |

163,5 |

168,8 |

5,3 |

3,2 |

|

Total Capital Expenditure |

99,2 |

159,0 |

59,8 |

60,3 |

|

Gross capital formation |

74,1 |

132,3 |

58,2 |

78,5 |

|

Other capital expenditure |

25,1 |

26,7 |

1,6 |

6,4 |

|

Net Lending (+)/ Borrowing (-) |

239,9 |

329,1 |

89,2 |

|

|

% of GDP |

0,9% |

1,1% |

|

|

Methodological Information

Data Coverage and Methodology

Information is provided for the whole sequence of accounts for the General Government sector. The revenue and expenditure are analyzed by category and these are classified between current and capital, respectively.

The categories of revenue and expenditure for General Government cover all the subsectors of the General Government based on the European System of Accounts 2010 (ESA 2010).

Source of Data

The data is collected from:

- Financial Information Management Automation System (FIMAS) for Central Government, Extra Budgetary Funds and Social Security Funds,

- Budget execution of Municipalities and Communities,

- Budget execution of Semi-Government Organizations.

For the completion of the estimates, any methodological adjustments or corrections based on the European System of Accounts 2010 (ESA 2010) are taken into account.

For more information:

CYSTAT Portal, subtheme Public Finance

CYSTAT-DB (Online Database)

Predefined Tables (Excel)

The Predefined Tables, available in Excel format, include data up to the first quarter of 2023.

Data from the second quarter of 2023 onwards will be available only in the CYSTAT-DB Online Database.

Contact:

Michael Panayiota: Τel: +35722602186, Email: pmichael@cystat.mof.gov.cy

(NG/ECHR)

Relevant Press Releases

19-04-2024 16:42

PIO e-mail Αlerts service is suspended

18-04-2024 14:04

Price Index of Construction Materials: March 2024

17-04-2024 13:26

Harmonised Index of Consumer Prices (HICP): March 2024